Protecting Personal Data: Requesting CVV via Mail is Against PCI Compliance

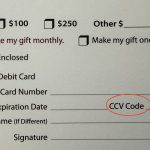

In an era dominated by digital transactions and online commerce, the security of personal financial information remains a paramount concern. One practice that raises red flags for security experts is the request for a CVV or a CCV via mail. A card verification value (CVV) or card verification code (CVC) is a 3 or 4-digit security code usually found on the back of your credit card. These codes provide a second layer of authentication, which helps to verify the cardholder’s identity when making remote transactions. During the holiday season, I received a direct mail piece from a California charity seeking donations. On the response device, this charity requested the CVV or CCV number as part of the credit card details.

This blog post aims to explore the reasons why asking for CVV details through postal services poses significant security risks for individuals and non-profit organisations alike.

- Vulnerability to Mail Interception: Mailing sensitive information, such as CVV numbers, exposes it to potential interception during transit. Unlike digital transactions with encryption and secure channels, physical mail can be susceptible to theft, interception, or unauthorised access. This increases the likelihood of financial fraud or identity theft if CVV details fall into the wrong hands.

- Lack of Secure Communication: Sending CVV numbers via mail lacks the security measures provided by digital communication channels. Emails and online transactions often use encryption and secure protocols to protect sensitive data. In contrast, traditional mail offers minimal protection, making it easier for malicious actors to intercept or tamper with the information.

- Non-Compliance with Payment Card Industry Standards: Asking for CVV information through the mail contradicts the Payment Card Industry Data Security Standard (PCI DSS), a set of security standards designed to protect cardholder data. Organisations handling cardholder information are advised against storing or transmitting CVV details due to their sensitive nature.

- Increased Risk of Fraud and Identity Theft: CVV numbers are a crucial security feature used to authenticate card transactions. Requesting this three-digit code via mail exposes individuals to potential fraud schemes. If intercepted, the CVV, when combined with other card details, can enable unauthorised transactions, leading to financial loss and identity theft.

- Alternative Secure Practices: Secure alternatives exist for card verification that do not involve transmitting CVV details through mail. For instance, using secure online payment gateways that authenticate transactions without requiring CVV numbers or employing two-factor authentication methods can enhance security without compromising sensitive information.

- Regulatory and Legal Implications: In certain regions, soliciting these details via mail might violate privacy and consumer protection laws. Organisations may be subject to penalties, legal repercussions, or reputational damage for mishandling sensitive financial information.

The security of personal financial data is paramount in today’s digital age. Requesting CVV details via mail poses inherent risks, including vulnerability to interception, non-compliance with industry standards, and increased susceptibility to fraud and identity theft. Organisations and individuals should prioritise secure practices, avoiding the transmission of sensitive card verification details through non-secure channels like postal services. Employing safer alternatives and adhering to industry standards will help mitigate risks and safeguard sensitive financial information from potential threats and unauthorised access.