Dana Farber asks us to prepare for tax time

Dana Farber asks us to prepare for tax time. It’s no secret Boston’s Dana Farber Cancer Institute (DFCI) has a solid planned giving department. DFCI, in fact, has a solid all around development program. They are the envy of many non-profit organisations and have had superior leadership over the last 15+ years. In this blog post, I have highlighted why DFCI is in the forefront of fundraising and, certainly, planned giving.

Dana Farber asks us to prepare for tax time. It’s no secret Boston’s Dana Farber Cancer Institute (DFCI) has a solid planned giving department. DFCI, in fact, has a solid all around development program. They are the envy of many non-profit organisations and have had superior leadership over the last 15+ years. In this blog post, I have highlighted why DFCI is in the forefront of fundraising and, certainly, planned giving.

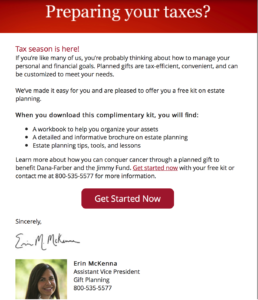

DFCI sent me an Email last week suggesting planned gifts are “tax-efficient, convenient, and can be customized to meet your needs”. The average US taxpayer is in the process of preparing their 2016 tax return (due on 15 April), the DFCI Email is timely and is surely to be effective in helping their supporters to think about DFCI and ways to minimise tax.

Planned gifts in the United Stated go well beyond bequests. The DFCI Email points out a number of planned giving vehicles available through DFCI, including: Gifts through your estate: Wills and living trusts, beneficiary designations, account designations; Gifts that provide you income: Charitable gift annuities, charitable remainder trusts; and More ways to give: Charitable lead trusts, real estate, and endowed gifts.

DFCI certainly has a menu of planned giving opportunities to offer supporters. These are planned giving vehicles unheard of in the average Australian non-profit organisation (even amongst the largest and most sophisticated charity).

DFCI suggested I download one or two of their booklets, including a lesson book and a record book. I downloaded both after first being asked to provide some basic contact details including my name and Email address. DFCI now has a means to contact me and has provided me something in return.